Hedging in forex

|

Getting your Trinity Audio player ready...

|

What is hedging?

Hedging is a risk management strategy. It allows us to limit drawdown on losing trades as well to protect open positions in an event of rapid price fluctuations. Hedging a position can be nothing more than opening a second trade of the same value, on the same currency pair, but in the opposite direction (direct hedging). For example, if one wants to hedge a short position, opening a long position is required, and vice-versa. Once the opposite position is open, the losing trade stops generating losses, since the loss on one trade is offset by profit on the other one. This is the simplest hedging strategy forex traders use, however, there are also more complex techniques.

Stop-loss vs direct hedging

The main difference between using a stop-loss and using forex hedging strategies is that a stop-loss means a trade is irrevocably closed with a loss. Opening a second trade in the opposite direction is just a second trade. Both stop-loss and direct hedging cut losses short. But using hedging strategies allows to generate net profit on both trades if properly managed. So a losing trade can still end with profit, or at least be closed at cost. However, properly implementing a hedging strategy is crucial here.

A trader whose position was closed by a stop-loss is out of the trade and can focus on regaining peace of mind or looking for a new opportunity. Only personal factors decide if the loss was emotionally damaging or not. The trade is gone, and the pressure is off. This is maybe the reason why many forex traders prefer to use stop-loss to hedging.

On the other hand, using a hedging strategy requires further risk management – this time for multiple positions. Also, additional costs related to opening a new trade occur. Focusing on existing trade may result in missing an opportunity for a new winning entry. However, the ability to close positions with a profit instead of a loss gives great satisfaction. It also builds self-confidence and allows one to stay calm in every situation. After all, if the price moves away from the original trade, it only means that there is another situation to manage. It can be a very valuable skill in case of rapid price fluctuations.

The worst thing that can happen when implementing a hedging strategy instead of using a stop-loss is a big and permanent price move in the other direction. In such a case, the positions would have to be closed either way at a net loss, not to generate financing costs related to the swap. But that would be exactly the same outcome as with the stop-loss plus the commission for opening another trade, which after all is not that big.

Hedging strategies and margin

In principle, once the position is fully hedged, no margin should be required (margin = 0). However, it’s not like this with all brokers and all currency pairs. With most brokers, margin on hedged trades is indeed zero. But I have an account with a broker which maintains 50% of required margin and another one that requires full margin on trades in both directions. Lastly, some brokers that in principle don’t charge margin on hedged trades, still require some margin on more volatile currency pairs, like for example EURNOK or USDMXN.

Most common forex hedging mistakes

One of the most common mistakes forex traders can make is not following their hedging strategy. As with everything in forex, hedging should also be done in accordance with a playbook.

Another one is taking profit on the opposite position. “I’ll take the profit and set another pending order just a few pips above the resistance,” one might think. In most cases, the result will be that the new pending order in the opposite direction will be opened either way (by a short price spike 😀 ), only for a price to return a while later to the initial trade. But the loss is already locked between the two positions, which are now wider apart. That is the moment one realizes that taking a profit was a huge mistake.

The third big mistake is trading without a hedging strategy. In such a case, all decisions are made purely under the emotional impulse and will only lead to a greater draw-down. Hedging strategies should be an integral part of your forex trading strategies and should be included in the trading plan.

A simple forex hedging strategy

Personally, I prefer using hedging instead of a stop-loss. I set the pending order in the opposite direction at a level where stop-loss would otherwise be placed. My hedging strategy requires that I wait for the price to go some 15-20 pips above that level. Then I look at my technical indicators for a pull-back signal. Once I see it, I set pending orders which close both trades automatically with a profit of 1 pip, and I wait for the price to reverse and do the job. If I had to keep positions overnight and have rollover costs, I might add some pips more in order to close both trades with a net profit. Of course once the initial trade is unhedged, I place a securing pending order again, at some distance from the current price.

Things that can damage or even blow a fully hedged account

So, you have a direct hedge on all trades, meaning that 100% longs have corresponding shorts. You feel safe going for a weekend or on holiday. You come back and boom! The account is damaged or even completely blown! How is that even possible? Here it is:

Forex hedging risk no 1 – the spread

During some major economical and political events spreads can widen dramatically. It is enough that extreme widening will occur for a second, and the trading platform can trigger stop-out. This can happen if margin falls below a certain level or if equity falls into negative territory. The latter can happen even if no margin is required for holding fully hedged positions, because Equity = Account Balance + Floating Profit/Loss.

During some major economical and political events spreads can widen dramatically. It is enough that extreme widening will occur for a second, and the trading platform can trigger stop-out. This can happen if margin falls below a certain level or if equity falls into negative territory. The latter can happen even if no margin is required for holding fully hedged positions, because Equity = Account Balance + Floating Profit/Loss.

Let’s assume a trader has an account with the following parameters:

Balance: 2000 USD

Floating loss on 1.3 lot each way positions: -600 USD

Equity: 1400 USD

Direct hedge margin requirement: 50% of regular 1:200 margin = 250 USD

A 1.3 lot position on 2000 USD account might seem too large, but different people use different strategies, and with leverage of 1:200 or higher the trade would be more than possible.

Lets assume that a trader opened a direct hedge on all positions for the weekend, locking -600 USD drawdown. The intention was to get out of the drawdown in the following week or transfer additional funds. But on Sunday, there was a piece of unexpected geopolitical news. On Monday, at Sydney open, the spread on that currency pair widened to 50 pips for a few seconds… 50 pips on 1.3 lot is 650 USD. From the point of view of the spread, a direct hedge is regarded as two separate positions. In the above case, spread widening influenced both the long and the short positions. So the total value of positions for spread purpose was 2.6 lots!

The floating loss of -600 USD increased by 2 x 650 USD = 1300 USD to -1900 USD. The equity fell to 100 USD, which is below 50% of the required margin. System stopped-out the trades and all the money in the account was gone, since all the positions were closed with a 50p spread in each direction. Science-fiction? See the screen shot taken at Monday Sydney Open after the Silicon Valley Bank collapse…

When forex market volatility is growing, spreads widen dramatically.

Conclusion: always have enough capital to withhold extreme spread widening. The worse thing you can do is to assume that you can hold just small capital in your account, because you have 100% direct hedge on all positions.

Forex hedging risk no 2 – swap

A hedge on any currency pair will result in the emergence of costs related to swap (called also rollover charges). It is nothing less than an interest payment for the capital involved in maintaining a leveraged trade overnight. There are currency pairs where the swap is positive in one direction (a long position in USDCHF can be an example), but there is no currency pair that would have a positive swap in both directions. So if a forex hedging strategy involves keeping a trade for several days, the swap costs will be automatically deducted from the equity. If the situation persists, it can eventually consume all the money in the account. In reality, forex hedging is not a long-term strategy. Rather an intraday one or a strategy you can use until the price moves to another level, since the swap costs can accumulate over time.

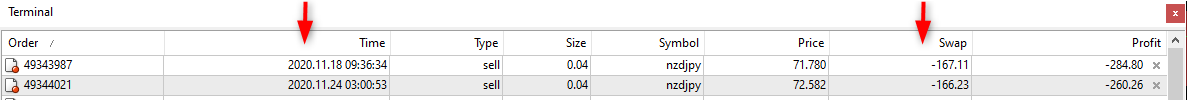

Example of positions opened originally for hedging purposes

It is always possible check the costs related to swap in the trading platform.

Forex hedging risk no 3 – conversion to the account currency

If an account is in the US dollars and the trade is on a currency pair in which the US dollar is the counter currency, like in EUR/USD or GBP/USD, then there is no problem – the profit and loss are expressed in the same currency as the account balance.

The problem starts when trading currency pairs in which the counter currency is different than the account currency. In such case, the profit and loss have to be converted into the account currency according to the current foreign exchange rates between the counter currency and the account currency. This poses an additional currency risk. Let’s look at an example of a hedged trade on AUD/JPY. Any profit or loss on this pair is expressed in JPY. If the account is in USD then both profit and loss on both the long position and the short position have to be converted to USD. In case of rapid exchange rate fluctuations, the equity will deteriorate even if the trade is 100% hedged because the overall value of both positions expressed in the account currency will decrease.

Other hedging strategies to offset currency risk

There are several ways to offset currency risk, especially for longer-term positions. They can be applied both to a new trade as well as to an existing trade. Buying forex options is one of them. Currency options are financial instruments that grant the buyer/holder the right, but not the obligation, to buy or sell a specific currency at a predetermined exchange rate (the strike price).

There are two main types of currency options: call options and put options. A call option provides the holder the right to buy a currency at the strike price, while a put option grants the right to sell a currency at the strike price. There are European and American style options. In case of the first one, the right mentioned above can be executed only on the specified expiration date, and in the second one, any time before the expiration date. Both types of options can be sold back on forex market at any time. In volatile fx market conditions the price of options can rise up rapidly.

An important note – selling forex options poses a significant risk to the seller since his profit is limited to the premium paid by the buyer, but his risk is unlimited. It is true especially for beginner traders who may regard it as “easy money”. If you think about selling options, you should first gain have and have appropriate risk management strategies in place!

Using options in forex hedging strategy

Options were originally designed to hedge currency risk in international trade. Using options can also be one of the forex hedging techniques, especially for longer-term trades. Let’s say we want to do carry trading – open a position on a currency pair that has a positive swap, eg. a long position on USDJPY. Every day the position is open, it generates additional income, since opening is effectively borrowing JPY at a low-interest rate and depositing USD at a higher interest rate.

Everything is fine till the time the trade runs in the direction expected. However, any price fluctuations can consume the income from the carry trade strategy and in addition generate a drawdown on the existing position. Using popular hedging strategies, in this case, would consume the profit generated on the carry trade and require active management of the trades. Buying forex options solves the problem since the only management which has to be done is to either collect the profit from the carry trade or from the option. The only risk is limited to the option purchase price – in case the option expires worthless and the trade did not make a move big enough to generate profit that would offset the premium cost.

***

If you’ve liked this article, you might also be interested in subscribing to my e-mail updates in the box below.

I also wrote some other articles you might like:

If you have friends who could be interested, please share this content with them: