Trading for a living – what’s needed to make trading a stable source of income

|

Getting your Trinity Audio player ready...

|

When one is planning to open a company, the first step should be writing a business plan. Or at least its financial part, to see what it will take for the company to break even and then to be profitable. Correct me if I’m wrong, but when it comes to trading, we need to conduct a similar analysis to see if the „profit margin” on the „product” will be sufficient to cover all „costs” and generate net profit. In this article, I share my thoughts and methodology on the subject. And no, it is not another article on a trading plan and why you should have one. A trading plan is an operational manual for your trading. What I’m writing about is a basic financial analysis of your trading system to check if you are able to meet your goals trading it.

When one is planning to open a company, the first step should be writing a business plan. Or at least its financial part, to see what it will take for the company to break even and then to be profitable. Correct me if I’m wrong, but when it comes to trading, we need to conduct a similar analysis to see if the „profit margin” on the „product” will be sufficient to cover all „costs” and generate net profit. In this article, I share my thoughts and methodology on the subject. And no, it is not another article on a trading plan and why you should have one. A trading plan is an operational manual for your trading. What I’m writing about is a basic financial analysis of your trading system to check if you are able to meet your goals trading it.

Why does financial math matter?

The answer is simple – most traders want to be able to trade for a living or to become rich. Even if your motivation is the latter, the first step on the path will be to break even and then to be able to make a living from trading. So, it would be good to know what it takes to reach these milestones and verify if your trading system is able to take you there.

“In this business, if you’re good, you’re right six times out of ten. You’re never going to be right nine times out of ten.”

Peter Lynch

The above quote was the starting point for my own analysis the first time I made it. No matter what you think or what profitable traders will tell you, no matter what the mentors and educators will promise, it would be arrogant to assume that a trader who is craving to become profitable will suddenly be right more than six times out of ten. It would even be fair to assume that at the beginning, it might be five times out of ten. At the beginning of my trading journey, I was arrogant and thought I would do better. Well, I have to confess that my ego suffered many, many times after that 😀 . Getting this assumption right is very important as it is the key parameter in the calculations I’m going to do.

The second important parameter is the Risk/Reward ratio, which I prefer to call the cost of a losing trade vs. profit from a winning trade since, in my opinion, the risk is not a static value (but more on this in another article). Sometimes you can hear „I’m OK with a 1:1.5 Risk/Reward ratio”. Or even 1:1. And that it is enough to have 50% of winning trades to be in profit. Well, in theory. Let’s look at a series of 40 trades with 1:1 Risk/Reward, that have 10p TP (take profit), 10p SL (stop loss), and 50% win rate:

1:1 R/R ratio

Losing trades: loss of (-10p) + commission of (-0.4p) = (-10.4p) x 20 trades = (-208p)

Winning trade: profit of 10p + commission of (-0.4p) = 9.6p x 20 trades = 192p

Net result = (-16p)

Now let’s look into similar trades, but with a 1:1.5 R/R ratio for comparison:

Losing trades: loss of (-10p) + commission of (-0.4p) = (-10.4p) x 20 trades = (-208p)

Winning trade: profit of 14p + commission of (-0.4p) = 14.6p x 20 trades = 292p

Net result = 84p

Some remarks on the above calculations:

The commission of 0.4 pip is a quite generous one, but there are good and reliable ECN brokers that offer cost-effective accounts. Still, it is a cost that has to be taken into account since it accumulates over time. You don’t want to have anything to do with brokers that don’t charge any commission for opening trades – they function as market makers and make their profit on your losses.

40 trades is not a random number – as there are around 20 trading days a month, two trades per day is a reasonable number for a day trader. You might need to adapt methodology a bit if you are more into longer-term trades or scalping.

Is trading for a living possible with a small risk-reward ratio?

For further deliberations, I’ll assume that the minimum monthly income we need to generate to be able to live from trading is around 4,000 USD. If this sum is too big for you, just reduce the below results proportionally. If it is too low, you might consider moving to a country with lower costs of living (that often has more to offer than your home country) 😀 .

Coming back to the calculations we’ve made – the monthly +84p result for 1:1.5 R/R makes one, in principle, a profitable trader. But when we realize we are talking about monthly profits, it starts looking a bit bleak. Unless we assume someone trades 5 lots, it will simply not generate enough money. Trading 5 lots in this case means being emotionally capable of coping with a loss of 500 USD (5lot x 10p = 500 USD) on a single trade while keeping in mind that the distribution of winning and losing trades is random, so there can be several losing trades in a row before a profitable one will show up. Just to be clear – risking the loss of an equivalent of the monthly profit target in eight 5-lot trades is not a good way to go. In my opinion, if you want to be able make a living from trading, a system with a Risk/Reward ratio higher than 1:1.5 is needed.

What is the minimum Risk/Reward ratio to look for?

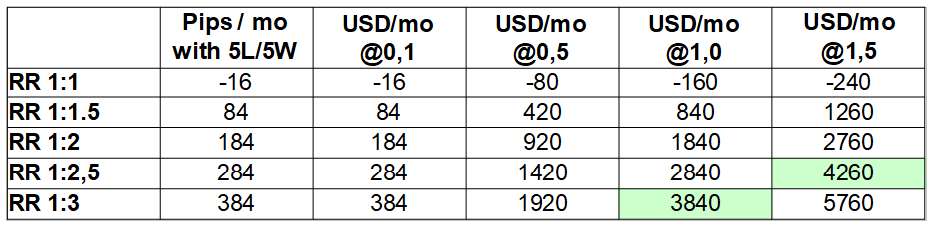

In the table below, I calculated monthly profits from a series of 40 trades for various R/R ratios and lot sizes while keeping the 50% win rate and (-10p) SL used in the calculations above (the broker commissions are included).

As we can see, we need the ratio to be at least 1:3 to get close to our target when trading 1 lot and 1:2.5 when trading 1.5 lot (keep in mind that these values might differ from pair to pair – they will be right for XXX/USD symbols).

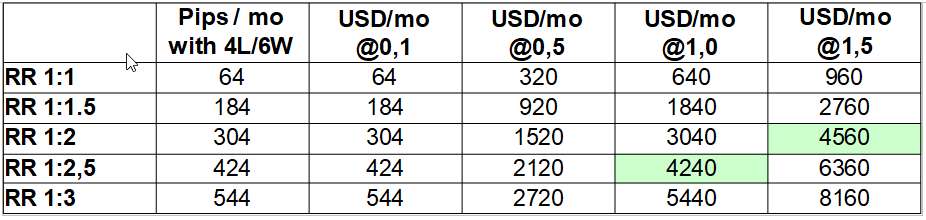

For comparison, I also calculated monthly profits for the above but with a 60% win rate (for those who are “good” according to Peter Lynch).

As we can see, with a 60% win rate, the Risk/Reward ratio can be smaller – 1:2.5 for 1-lot trades and 1:2 for 1.5 lots. If we maintained a 1:3 R/R ratio, we could trade with a smaller lot size, which, in my opinion, is a more sustainable way to go.

Is it realistic to make a living from trading?

Since most currencies have an average daily range of at least 60p, having two trades with an SL of (-10p) and 1:2.5 – 1:3 RR a day on average is realistic. Some of these trades will be winners and some will be losers. As it has been calculated, with 1:2.5 – 1:3 R/R, it is sufficient to be right five times out of ten, so no need to be a genius trader who is never wrong to be able to earn a living.

If you go for longer-term trades, you might need to calculate daily averages to make a similar analysis since the trade duration will be longer, and the profit target will be bigger, as well as the stop loss. Probably, you will have to wait longer for entries, and there will be fewer trades per month. It will take more time till you can bank profits. There might also be some other risk factors on the way that might eat up your gains. On the other hand, if you scalp, you might need to do more trades per day and be exposed to risk more often to get to the required monthly pip value.

However, as we can see from the tables above, the odds of success increase dramatically as the Risk/Reward ratio increases. Finding the right balance is crucial. The balance between the size of a single trade and the number of trades per day. And the balance between the cost of a single losing trade and the profit from a single winning trade. Checking if a trading system makes it possible to generate sufficient profit from a winning trade vs. the cost of losing trade so that you can make enough money with the lot size you are willing / are able to trade is definitely a good way to start (or restart, or start again 😀 ).

***

If you’ve liked this article, you might also be interested in subscribing to my e-mail updates in the box below.

I also wrote some other articles you might like:

If you have friends who could be interested, please share this content with them: