Understanding currency cross pairs

|

Getting your Trinity Audio player ready...

|

Cross currency pairs – introduction

There are 28 main currency pairs traded on the forex market. The major currency pairs or the majors are EURUSD, GBPUSD, AUDUSD, USDCAD, USDJPY, USDCHF, NZDUSD, and the minor currency pairs or the minors are EURGBP, EURCHF, EURCAD, EURJPY, EURAUD, EURNZD, GBPJPY, GBPCHF, GBPAUD, GBPNZD, GBPCAD, CADCHF, CADJPY, CHFJPY, AUDCAD, AUDCHF, AUDNZD, AUDJPY, NZDCAD, NZDCHF, NZDJPY.

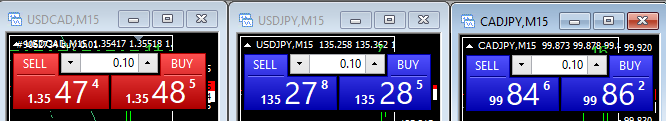

When we log onto a trading platform we see quotes available for any of them. What we don’t see is that for the minors, which don’t include the US dollar in their symbol, the exchange rate is actually calculated from two major pairs. Let’s take the CADJPY as an example. Although you can trade it from a trading platform and have a CADJPY chart, in reality, the price of this currency pair is calculated from USDCAD and USDJPY. So the CADJPY rate is dependent on the price movements of the two underlying major currency pairs. If we take a screenshot of real-time rates of USDCAD, USDJPY, and CADJPY at any given moment, we can observe the following:

Buy price for CADJPY is 99.86 = Buy USDJPY @ 135.28 / Sell USDCAD 1.3547

Sell price for CADJPY is 99.84 = Sell USDJPY 135.27 / Buy USDCAD 1.3548

A complete explanation of how cross currency pair price is calculated can be found at the end of this text.

The price of almost every cross currency pair is calculated in a similar way – based on the price of two major currencies. This is the reason why pairs that do not include US Dollar are also called cross pairs, cross currency pairs, cross rates, or crosses. The spread on the cross pairs is usually larger than the spread on the majors, because it includes the spread between both of the major pairs which were used for calculating the price of the cross currency. The same goes for swaps. The patterns or signals on the charts of the cross pairs are a reflection of moves on the charts of the underlying majors. Of course, forex traders executing trades on cross currency pair based on these patterns influence also to some extent the price of the majors since, back to the CADJPY example, eg. shorting CADJPY, is actually buying USDCAD (selling CAD, buying USD) and selling USDJPY (selling the USD and buying JPY). However, the influence of these transactions might not be that big, taking into consideration volumes traded on majors vs minors.

Share of different currencies in the forex market

The main reason for calculating prices of cross pairs using the major currencies is simple – there is too small volume to facilitate direct exchange. To show a broader perspective – according to the BIS Triennial Central Bank Survey (https://www.bis.org/statistics/rpfx22_fx.htm), the turnover of OTC FX markets averaged $7.5 trillion/day in April 2022. The US Dollar was a side of nearly 88% of all those transactions, with the majors generating nearly 70% of the turnover: EURUSD 22.7%, USDJPY 13.5%, GBPUSD 9.5%, USDCNY 6.6%, USDCAD 5.5%, AUDUSD 5.1%, NZDUSD 3.9%.

A cross currency pair with the biggest turnover – EURGBP – accounted for just 2% of the total volume mentioned above. Other major currency crosses with the highest trading volume are EURJPY (1.4%) and EURCHF (0,9%). Each of the other cross pairs accounts for less than 1% or even less than 0,5% of exchange volume. So, it is simply easier to exchange one currency to USD and buy the other currency for USD (in our example converting CAD to USD and then USD to JPY), than finding two parties that would like to transact directly at the same time, for the same amount, one willing to sell Canadian Dollar and buy Japanese yen, other willing to buy Canadian Dollar and sell the Japanese Yen.

How the US dollar influenced AUDCHF

A good example to illustrate the influence of major pairs on the price of a cross pair is the development on AUDCHF in the second week of March 2023. Within two days, the pair fell sharply. However, there was no any event nor economic data release in Australia that would justify that. And Australians did rush en masse to exchange Aussie for Swiss Frank. The only reason for that rapid depreciation of AUDCHF was the fact that AUDCHF is actually AUDUSD x USDCHF. And US Dollar depreciated against the Swiss Frank on the verge of panic related to the Silicon Valley Bank collapse. With no strong moves on AUDUSD on those days, it was USDCHF depreciation that dragged AUDCHF down.

Just for a reminder – the Silicon Valley Bank in California collapsed due to a bank run on deposits. The bank had its capital invested in US Treasury bonds which happen to lose market value due to FED’s rate hikes. If the bank could wait till the bonds mature, then everything would be fine since they had the money to pay their depositors. It was just stuck in government bonds, that could be easily sold under normal market conditions. However, they had to fire-sell the bonds at a loss due to some issues related to their credit rating and higher-than-usual volume of withdrawals. This spiraled into a bank run. The SVB collapse caused concerns that a crisis related to held-to-maturity bonds might spread across the banking sector in the USA, bringing more banks under. As you see none of this was related to the Australian or Swiss economy. Just a panic run to safety. But it is a great example that illustrates how moves on a major currency pair were immediately reflected in the price of a currency cross pair.

Exotic pairs and exotic cross currency pairs

First of all, exotic pairs are not necessarily related to the currencies of exotic islands 🙂 . These are just pairs that include currencies of smaller economies which make even smaller trading volume than the minors. An example of such a currency pair can be USDNOK (US Dollars vs Norwegian Krone) or USDPLN (US Dollars vs Polish Zloty). There are also exotic cross pairs that do not include US Dollar. An example of that can be one of my favorite pairs – CHFSGD (Swiss Frank vs Singapore Dollar). Of course, like with the major crosses, its price is calculated from USDCHF and USDSGD. Exotic crosses tend to be more volatile and have larger spreads and swaps, but if traded correctly they have a great profit potential.

Trading cross currency pairs

Knowing the above, we can see that a smart way to trade cross currency pairs is via observation of the major currencies used for their price calculation. Let’s have a look at an exemplary situation. We see that USDCAD is approaching support and USDJPY is hitting the resistance. Other signals are confirming buy for the first pair and sell for the latter. One could trade any of these major pairs or both of them at the same time. But in this case, trading the cross currency is like making a trade with an accelerator. Using the same deposit one can benefit from the move of both major pairs. Let’s say our strategy and deposit allow us to trade 1 lot at a time. We can either go 1 lot long USDCAD or 1 lot short USDJPY or split 0,5 lot between those two trades. We can also pick a cross currency – in this case CADJPY and go 1 lot short on it, since shorting CADJPY is nothing else than buying USD for CAD and then selling USD and getting JPY. Let’s see how it would play out in money terms (I rounded up the results to whole numbers and skipped the commissions and spreads to not complicate it even further).

Two trades on majors vs a trade on a cross pair

A 1 lot +15 pip short on USDJPY from 135.27 to 135.12 would generate a profit of 15.000 JPY or 111 USD.

Assuming that USDCAD made also a 15 pip move, if, instead of this we opened simultaneously two 0,5 lot trades, one on USDJPY and the other on USDCAD, the results would be as follows:

-

0.5 lot short on USDJPY from 135.27 to 135.12 would generate a profit of 7500 JPY or 55 USD.

-

0.5 lot long on USDCAD from 1.3548 to 1.3563 would generate a profit of 75 CAD or 55 USD.

-

The total profit on both trades would be 110 USD.

Taking into consideration the above price moves, the CADJPY price would be down from 99.84 to 135.12 / 1.3563 = 99.62. This is a 22 pip move and 22.000 JPY or 162 USD profit on 1 lot trade.

All the trades used the same margin and benefited from the same price moves, but the one on a cross pair generated a 50% higher profit!

Cross currency pairs – summary

As we can see, trading a cross currency pair generated a higher return than trading the majors. Another good thing when trading cross pairs is that when the price action of one major pair does not change much or even goes in the opposite way, a dynamic price action of the other major pair can still move a cross currency trade into profit, or at least allow for exiting it with no loss. A diversification without diversification.

A word of caution, however – the movements on cross pairs tend to be wilder than in the majors. So if you don’t know what you are doing (don’t have a reliable system and signals which would tell you what is going on with the underlying majors), then the losses can also accelerate faster when trading cross pairs. This is why I suggest to master trading on majors first and only after that I started trading crosses.

Cross currency pairs trading aid

To make trading currency crosses easier I prepared an info-sheet with a cross currency correlation table, which you can download for free from my encrypted drive, print, and use as a trade aid.

How is the price of the cross currency pairs calculated

When it comes to cross currency price calculation, three different configurations of the majors are possible. The calculation method depends on whether the US Dollar is the base currency in both underlying pairs, just in one or in none.

Case 1. CADJPY

US Dollar is the base currency of both major currencies involved. The price of CADJPY is calculated by cross-dividing USDJPY by USDCAD.

Case 2. GBPJPY

USD is the quote currency in one major pair involved and the base in the other. The price of GBPJPY is calculated by multiplying the buy price of both pairs or the sell price of both pairs.

Case 3. GBPAUD

USD is the counter currency or quote currency in both major currencies involved. The price of GBPAUD is calculated by cross-dividing GBPUSD by AUDUSD.

***

If you’ve liked this article, you might also be interested in subscribing to my e-mail updates in the box below.

I also wrote some other articles you might like:

If you have friends who could be interested, please share this content with them: