The truth about prop firm trading – a must-read

|

Getting your Trinity Audio player ready...

|

Every trader will at some point come across information about proprietary firms and prop firm trading. While this is a great opportunity to scale up and take your trading to another level one has to be aware of a few things that in reality are not as they might seem at first look. Discovering how things work can help you pass the prop firm challenge and achieve long-term success as a funded trader.

A closer look at prop firm trading account

If you look at any prop firm’s website you’ll discover that they offer evaluations for different account sizes starting from 5000 USD and going up to 200,000 USD. The prices for evaluation start from as little as some 40 USD for accounts of around 5k and go up to around 1000 USD for the largest accounts (200k). Let’s take a 100,000 USD account as a reference and dive into the details.

A typical 100,000 USD account prop firm challenge costs around 500 USD. All you need to do to become a funded trader is to grow your account by some 10% in the first stage of the challenge and some 5% in the second stage. Some proprietary firms also offer one-step verification where you get funded after successfully finishing the first stage of the challenge. On top of that you are not allowed to make more than 5-10% loss/drawdown. The available leverage varies from 1:10 to 1:100 with 1:30 being the typical value.

At first glance it looks great – you pay a fee equaling some 0.5% of the money they will make available to you and have to make some 15% of profit while not losing more than some 10% (varies from firm to firm). However, if you give it a thought then you realize that when you have a 100,000 USD account with your private money you may trade with it until the whole 100,000 USD is gone and no one will close your account because you are 11% in drawdown.

This is the point when one realizes that while technically you are given a 100,000 USD account in reality you can not lose more than 5000 – 10,000 USD (depending on the company). In consequence, you have to maneuver with your losses and draw down within this range. It is a significantly different situation than with your private account or a demo account where the whole equity is your limit. So, technically you have a 100,000 USD account (and your leverage will be calculated based on this value) but from a risk management perspective, you actually have just 10,000 USD.

The reality of prop firm trading

The hidden truth is that if you want to trade the account responsibly (which is what all prop firms expect from you) you should consider the max drawdown amount when managing the risk, not the nominal account value. To prove my point let’s do some math.

If you were to use conventional trading wisdom and risk 2% of the account value per trade, then for a 100,000 USD account it would be 2000 USD. However, if you are trading for a proprietary firm your max permitted loss/drawdown is 10 000 USD. So if you risk 2000 USD per trade it takes only five trades to blow the account. Even if you would go for a conservative risk of 1% of the account value per trade it would take just ten losing trades to blow the account. And it’s not going to be better because the 5-10% max permitted loss/drawdown will stay once you get funded.

In reality, the only reasonable way to manage risk for a prop firm trading account is to calculate your risk parameters using not the account value but the max permitted loss/drawdown value. Sure, the nominal account value can be useful for leverage purposes when your trade is in profit and you want to pyramid. Then being able to scale up to 30 lots (with 1:30 leverage and 100 000 USD trading account) is great. However, placing a 30 lot trade on the first entry would be simply irresponsible since it would take just three trades with a 10p loss to practically blow the account. Serious prop firms don’t want you to trade this way and trading large lot sizes does not prove your professionalism but rather the fact that you don’t understand the risks and limits involved in prop firm trading.

Realistic approach to prop firm trading

So what does managing risk for a prop firm trading account mean? If we applied the conventional rule of not risking more than 2% to the 10,000 USD of permitted loss/drawdown it would translate to a maximum of 200 USD of loss/drawdown per trade. This is 50 losing trades in a row before the account is blown.

However, with this conservative approach, it might take a while to pass the prop firm challenge. Just for a reminder – for a 100,000 USD account you typically have to earn some 10,000 USD in the first stage and another 5000 USD in the second stage of the evaluation (15,000 USD in total). So, let’s see what it would take to get funded:

A system with a 1:2 risk-reward ratio and a 50% win rate

With 200 USD at risk a 400 USD profit per winning trade would be earned. That averages to 100 USD profit per trade. If we consider that we would need:

15 000 USD / 100 USD = 150 trades to reach the profit target.

A system with a 1:3 risk-reward ratio and a 50% win rate

With 200 USD risk and 600 USD profit per winning trade would be earned. That averages to 200 USD profit per trade. If we consider that we would need:

15 000 USD / 200 USD = 75 trades to reach the profit target.

As you can see, in order to pass the prop firm trading challenge some 150 trades are needed for 1:2 RR system and some 75 trades for 1:3 RR system. In practice, this boils down to some 3-6 months of trading depending on what your distribution of winning and losing trades during the evaluation will be.

One could make the case that a good trader who knows the job can do it in a shorter time (I heard of people passing in a week), but it all depends on the circumstances, like market conditions. Considering that in the scenario we analyzed above we risked 2% of the max loss/drawdown per trade and had a buffer of 50 trades, there is theoretically some space to maneuver and effectively reduce the time for passing the prop firm trading challenge. If one is comfortable with risking 4% of the max loss/drawdown and a buffer zone of 25 trades, then the time indicated above can probably be slashed by half.

However, we have to take into consideration, that we assumed a 50% win rate for our calculations which might be quite an optimistic assumption. So passing a prop firm trading challenge while using a decent risk management strategy will be in most cases a matter of months rather than weeks.

How much can you earn when trading a prop firm account?

Even if you decided to increase your risk significantly during the prop firm trading challenge to shorten the time needed to pass the evaluation, you might want to reconsider that once you get funded. You don’t want to spend money and time on passing the prop firm trading challenge just to lose your account shortly after that. Probably risking more than 4% of the permitted loss/drawdown (or allowing yourself for less than 25 losing trades before blowing the account) would not be sustainable at this stage.

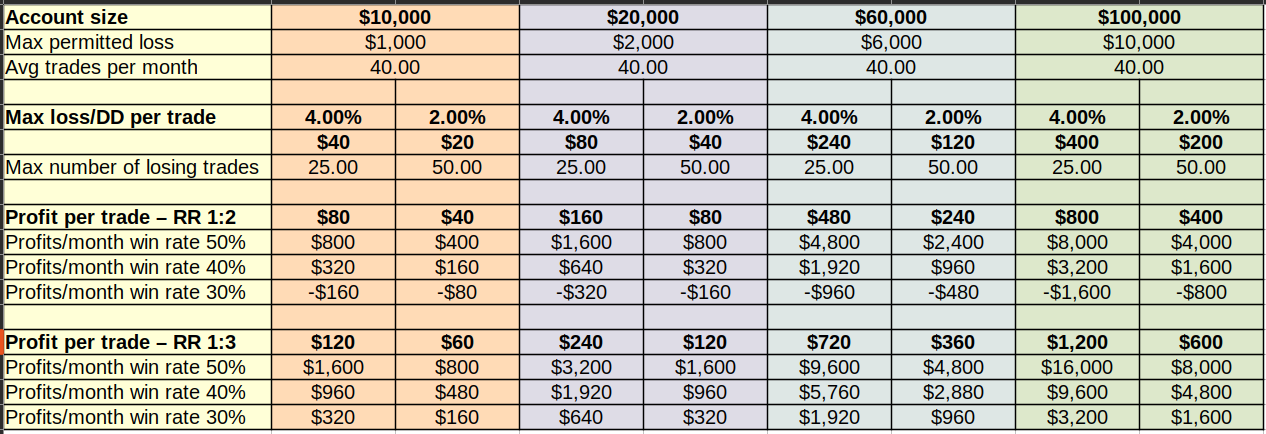

Having said that, let’s see what could be the possible trading results for various risk profiles, risk-to-reward ratios, and win rates:

As you can see the profitability depends on various factors and for a 100,000 USD account can vary from 1600 USD to 8000 USD per month which is perhaps less than one would expect. But we have to remember that we actually should look at it as a 10,000 USD account…

Is it all legit?

From time to time I come across opinions that prop firm trading challenges are designed to make traders fail them. Or that the prop firms make people lose their accounts shortly after the verification. For sure there are bad guys out there who simply want the money for evaluation and it is in their interest that most traders fail. However, in my opinion, the real problem is that people don’t understand the reality they are trading in. This brings us back to the issue of inaccurate communication that is present on an industry-wide scale that I mentioned at the beginning of this text.

In a way, I understand why proprietary trading firms do this little marketing trick by offering large accounts that can hardly be used in practice. Everyone in the prop firm industry does that and there is a good reason for that. It is easier to sell a 100,000 USD account challenge (with a max loss of 10%) for 500 USD which is 0,5% of the account value than to sell a 10,000 USD account challenge (with a max loss of 100%) for 500 USD which in this case would be 5% of the account value. In the latter case, one would immediately reconsider if it’s worth it. It also looks much easier to increase the account value by just 15% to get funded than to increase it by 150%, which in my opinion is actually the case in reality.

I don’t have any data to support this thesis, but I guess that many people fail the challenge because they try to trade a 100k prop firm account as they would normally trade a private or demo 100k account, while they actually should trade it like a 10k account…

Keep also in mind that buying a prop firm challenge is not an investment, so the investor protection laws do not apply here. You pay for an evaluation service, not deposit money into a brokerage account. It is an important distinction because I often see confused people pointing out that prop firms are not licensed to collect money from investors. They do not. They are paid by their clients who purchase their product – the evaluation packages. Again the marketing is to blame here because in various articles, one can read about “buying a trading account”. But this is not the case. Once again – you don’t invest but pay for the evaluation service. When you pass the evaluation and get funded you become a subcontractor of the prop firm. You are not an investor at any stage.

Is it worth to be a funded trader?

My answer would be definitely yes! As long as you know what game you are playing this is a great way of making money without actually risking your own funds. While there are boundaries that you have to respect I would argue that having them is only for the better – you can become a better and more disciplined trader.

Looking from the financial perspective, you are risking a relatively small amount of money you pay for the challenge and after that, you trade risk-free. In the worst-case scenario if a flash crash or a similar event happens it is the firm that loses money – you lose only your account. You can apply for a new verification instantly and have the trading capital back without having to earn any money back.

***

If you’ve liked this article, you might also be interested in subscribing to my e-mail updates in the box below.

I also wrote some other articles you might like:

- “Trading for a living – what’s needed to make trading a stable source of income”

- “Risk management in trading”

If you have friends who could be interested, please share this content with them: